祝贺白文涛同学顺利通过博士论文答辩|DBA捷报

发布时间:2020-08-14 19:16

一分耕耘,一分收获,2020年8月14日,长江商学院企业家学者项目四期班同学、深圳市分享成长投资管理有限公司执行合伙人白文涛顺利通过论文答辩。白文涛同学围绕《中国众筹式股权投资平台的风险控制体系构建——基于股权众筹与传统风险投资差异的比较研究》进行了深入地分析,研究成果丰硕,并在答辩现场严谨地回答了导师们的问题。恭喜白文涛同学顺利通过答辩!现在就让我们一同回顾答辩时的精彩瞬间。

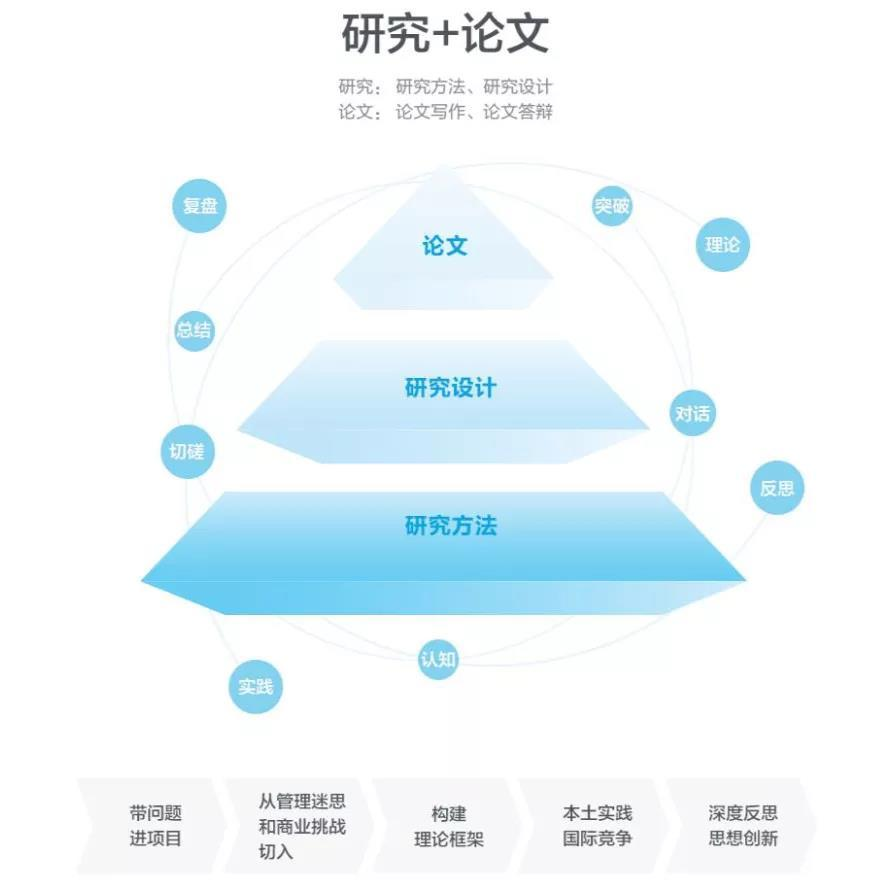

企业家学者项目以成就新商业文明思想者和引领者为愿景,打造极具前沿性和系统性课程,以框架模块、聚焦模块、专题研究+实践课堂等三大核心为课程主轴,整合全球优质教育资源。课程涵盖2大金融主题与4大微观主题,探索6大宏观方向,定制化行业专题,走访行业内领军企业,旨在帮助同学们实现“理解 - 判断 - 实践 - 引领”的跨越式发展与提升,成为新商业文明的先行者。白文涛同学经过完整的体系化学习与研究,迈进了探索真知的新格局和新高度。

本次论文答辩,来自长江商学院和新加坡管理大学(SMU)的教授们共同见证了白文涛同学的学术成果。

白文涛同学答辩中

▇ 论文摘要:

股权众筹是一种通过互联网技术实现的公开小额股权融资活动,是区别于传统风险投资的一种新型股权融资方式,极大地解决了中产阶级股权投资难和中小创企业融资难获客难的两大问题,有利于多层次资本市场的建设和金融体系的健康发展。由于股权众筹的诸多优势,近年来全球股权众筹市场发展迅速。遗憾的是,中国关于股权众筹的正式立法迟迟没有出台,各个平台只能以一种众筹式股权投资平台的形式存在,并且绝大多数平台一直在野蛮发展,完全没有建立起有效的风险控制体系,风险项目频发,投资人损失巨大。本文提出的风险控制体系构建针对的就是因非系统性风险导致的股权众筹投资者面临投资损失的风险。风险控制体系构建既包括项目风险层面上狭义的风险控制,也包括平台整体业务流程中各个方面的风险控制。

本文首先回顾股权众筹研究领域的文献和监管实践。学者们针对股权众筹主要从参与各方的行为动机、影响融资成功的因素、风险和应对风险的对策四个角度进行了研究。在风险应对方面,绝大多数学者将降低股权众筹风险的方式寄希望于从国家层面完善相关的法律法规并由国家相关部门强化监管。各国的监管实践都体现了股权众筹背景下促进资本形成、提高融资效率和投资者保护平衡的考量。总的来看,一是通过投资者适当性和投资者投资限额来保护投资者;二是通过股权众筹平台发挥信誉中介防范风险的作用来保护投资者。

之后,重点分析了中国股权众筹风险成因,包括融资方特性及投资风险、投资方特性及投资风险、信息不对称、委托代理冲突、平台过于追逐短期利益等。

针对中国股权众筹风险的成因,在比较股权众筹和传统风险投资的异同的基础上,提出了中国众筹式股权投资平台风险控制体系设计的具体措施,和平台整体风险控制体系的构建。并对风险控制体系设计中提出的项目风险评估及分级和投资者管理中的风险偏好及承受能力评估进行了更为深入的分析。在项目风险评估及分级方面,本文提出了使用AHP层次分析法和模糊综合评价法相结合、定性定量相结合的方法,使项目风险评估及分级更为准确科学。在风险偏好及承受能力评估方面,通过调查问卷了解投资者的情况,并使用最优尺度对问卷数据进行回归,并发现年龄、教育程度、家庭可支配年收入与投资者的风险偏好及承受能力显著相关,而且年龄和家庭可支配年收入的重要性更高。

随后,又以国内平台真实的投资案例对风险控制体系进行案例分析,并发现本文所提出的风险控制措施更好地提示了项目的风险,更有利对项目进行定位和决策,能够更好地保护投资者的利益。

最后,在对全文进行总结的基础上,提出了对未来研究的展望,希望通过持续不断的跟踪调查,更好地验证风险控制体系的有效性。

答辩现场

▇ Abstract:

Equity crowdfunding is a new type of public financing activity realized by Internet technology with small single investments funds, which is different from traditional venture capital. It greatly solves the equity investment problem of middle-class people and the difficulties of small and medium-sized enterprises and start-ups in financing and customers obtaining. It is also conducive to the construction of multi-level capital market, and the healthy development of national financial system. Due to the advantages of equity crowdfunding, the global equity crowdfunding market has developed rapidly in recent years. Unfortunately, China's formal legislation on equity crowdfunding has not been introduced yet. Each platform can only exist in the form of a crowdfunding-alike equity investment platform, and most of them have been developing savagely with no effective risk control system established at all. Investment failure occurs frequently and investors suffer huge losses. The risk control system in this paper targets at the investment loss risk faced by equity crowdfunding investors due to non-systemic causes. The construction of the risk control system proposed here include not only the narrow-scale risk control at the project level, but also the various aspects of the overall business process of the platform.

This paper first reviews the literature and regulatory practices in the field of equity crowdfunding. Scholars have conducted researches on equity crowdfunding mainly from the perspectives of the participating parties’ behavior motivation, factors affecting the success of financing, risks of equity crowdfunding and countermeasures to deal with the risks. In terms of risk countermeasures, most scholars hope to reduce the risks by improving relevant laws and regulations at the national level and strengthening supervision by relevant national departments. At present, global regulatory practices of equity crowdfunding reflect the considerations of promoting capital formation, improving financing efficiency and balancing investor protection. In general, one way is to protect investors through the investor appropriateness and the investment limit; the second way is to ensure equity crowdfunding platforms to play the role of credit intermediaries to prevent risks.

白文涛同学在企业家学者项目

After that, this paper focuses on the analysis of causes of equity crowdfunding risks in China, which include the characteristics of the financing parties, the characteristics of investor, information asymmetry, principal-agent conflicts, and the platforms’ excessive pursuit of short-term interests.

In view of the causes of equity crowdfunding risks, based on the comparison of the similarities and differences between equity crowdfunding and traditional venture capital, specific measures and the overall construction of risk control system of China’s platforms are proposed. Then, the project risk assessment and classification and the investor risk preference and tolerance evaluation, which are put forward in the risk control system, are analyzed in depth. In terms of project risk assessment and classification, this paper proposes the method of combining Analytic Hierarchy Process and fuzzy comprehensive evaluation, combining qualitative and quantitative methods to make the assessment process more accurate and scientific. In terms of investor risk preference and tolerance evaluation, a questionnaire is used to better understand investors, and the optimal scale method is used to regress the questionnaire data. It is found that age, education level, family disposable annual income are significantly related to investors' risk preference and tolerance, among which age and family disposable annual income are more important.

Subsequently, a case study of the risk control system is conducted with real investment cases on one domestic platform. It is found that the risk control measures proposed in this paper better reveal the project risks, and are more advantageous for making judgment regarding the project and protecting the interest of investors.

Finally, on the basis of summary, the prospect of future research is proposed, hoping to better verify the effectiveness of the risk control system through continuous follow-up research and investigation.

合影

论文答辩虽然结束,但对于白文涛同学以及他的管理学研究而言,这只是一个新的起点。未来,白文涛同学将带着自己在企业家学者项目的所学所得,继续投身于管理学思考与工作实践。我们也期待他在未来的企业管理中,继续为新商业文明发展助力!